Innotop Pharma AMC

WHY ZURI-INVEST AND PHARMACEUTICAL EQUITIES?

Invest together with us

OPPORTUNITY

Investment in the growing pharmaceutical through an expert backed selection to set the portfolio - the AMC: SUM Innotop 9-10 Pharma Selected ADJ.

FOCUS

Focus on two categories of companies:

- Top pharmaceutical companies: based on company profile, financial ratio, current and R&D portfolio.

- Innovative pharmaceutical companies: based on current and R&D portfolio, potential to be target for an acquisition.

EXPERIENCE

An experienced team in stock picking supported by pharmaceutical industry advisors.

NETWORK

Global network within the pharmaceutical industry.

INDEPENDENCE

Independent, privately-held and regulated management company with the principal money invested alongside in the portfolio.

The product’s strategy

TOP DOWN

Due to the ageing of the global population and still unmet therapeutic needs, capitalize on the continuous and sustained growth of the pharmaceutical sector in times of inflation and debt expansion.

VALUE APPROACH

Continuous evaluation and selection of the best performing equities in both groups, top pharmaceuticals as well as innovative pharmaceuticals, in line with defined fundamental criteria driving value creation.

DUE DILIGENCE

Stringent in-house due diligence process and regular portfolio analysis and rebalancing.

LIQUIDITY

Focus on liquid equities in order to rebalance the portfolio.

DYNAMIC

Dynamic investment style allowing to capture short- and medium-term trading opportunities.

TRANSPARENCY

Transparent communication to investors, regular disclosure of the AMC performance and major events such as acquisitions and breakthrough innovations.

EXPERTISE AND COMMITMENT

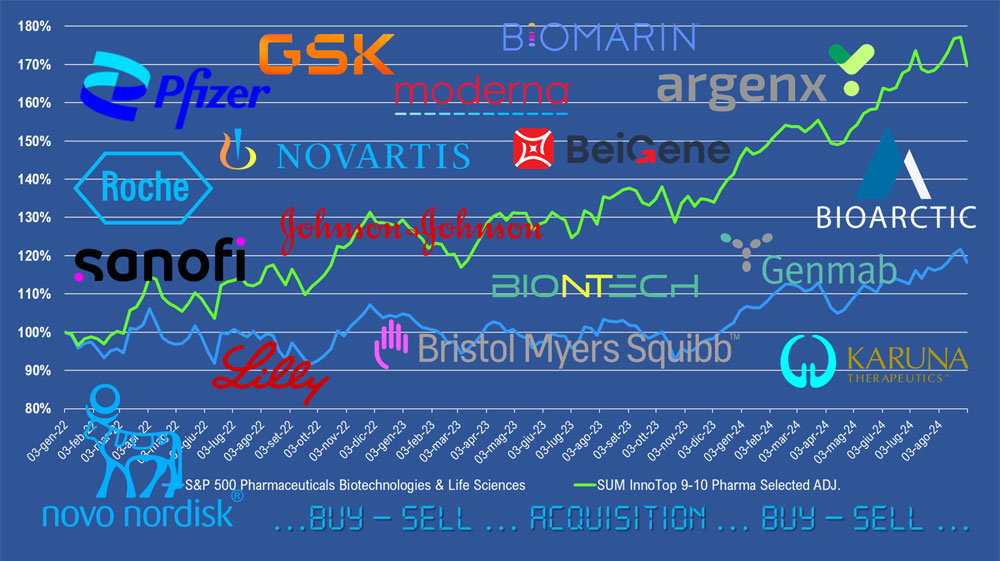

The strategy of SUM Innotop 9-10 Pharma Selected ADJ. is the outcome of the in-depth pharmaceutical market analysis of sales, capitalization, financial and R&D data accompanied by further selection and integration of equities aiming at capturing value creation in the pharmaceutical sector. The resulting AMC portfolio is a dynamic mix of roughly 75% equities of best-in-class companies - 10 top pharmaceutical groups, likely to deliver growth with a moderate volatility, and of roughly 25% of more dynamic, R&D oriented companies which often are potential candidates to be acquired - 9 innovative pharmaceuticals, likely to boost growth but with higher volatility.

The commitment is to outperform the market, based on constant monitoring and ad hoc rebalancing of the portfolio.

Objective

Outperform the market capitalization growth as represented by the S&P 500 Pharmaceuticals, Biotechnologies & Life Sciences index.

Strategy implementation

The Product’s strategy aims at capturing an optimized value creation through ongoing portfolio review by Zuri-Invest’s management team and external advisors. In case companies within the portfolio would be acquired or underperforming, they can be promptly substituted by applying well-defined selection criteria to new portfolio additions in order to deliver a performance in line with the preset objective.

Through the expertise in analysis of the pharmaceutical sector and the market skills required, Zuri-Invest uniquely brings together the ingredients to successfully execute on the strategy. In line with the strict investment criteria, the principals and external advisors use their know-how to constantly analyze, select and invest in the best matching equities.

INVESTMENT PROCESS - EQUITY

Focus on in-depth company diligence to mitigate investment risk :

Annex 1

IN A SPECIALIZED MARKET SEGMENT, STOCK PICKING AND ACTIVE MANAGEMENT ARE KEY

Monitoring equities, sales, financial ratio performance, and R&D progress is pivotal for capturing the best opportunities ...

In recent years a strong correlation between sales and capitalization has been observed in the pharmaceutical market. According to experts, the pharmaceutical market is likely to deliver a CAGR between + 3% to + 7.0% until 2033, which should consequently generate a similar market capitalization increase.

The predicted evolution of the S&P 500 Pharmaceuticals, Biotechnologies & Life Sciences index, the most reliable index featuring the capitalization of the pharmaceutical sector, should therefore be in the range + 3% to + 7% until 2033.

Thanks to a multitude of back-testing models, simulation of different portfolio mixes and a variety of forecasting tools, the equities selection and classification process was well established in order to deliver a performance above market as represented by the S&P 500 index.

The top pharmaceuticals are classified using stringent criteria in 3 categories: Drivers; Performers; Followers, of which only Drivers and Performers can enter into the AMC.

The innovative pharmaceuticals are classified upon stringent criteria in 3 categories: Champions; Challengers; Outsiders, of which only Champions and Challengers can enter into the AMC.

Upon their performance, companies’ categorization can be upgraded or downgraded, and new companies can enter into the radar scope.

PRODUCT STRUCTURE

PRODUCT DOMICILE: Switzerland

PRODUCT TYPE: Actively Managed Certificate

PRODUCT CURRENCY: USD

DENOMINATION: 1 Unit

MINIMUM INVESTMENT: 50 Units

ISIN NUMBER: CH1357422372

MANAGEMENT FEE: 0.7 % p.a.

ADMINISTRATION FEE: 0.3 % p.a.

PERFORMANCE FEE: 10 % above Hurdle Rate with High Watermark

HURDLE RATE: 5 %

TRADING: Weekly

STRATEGY MANAGER: Zuri-Invest AG, Zurich

PAYING AGENT: InCore Bank AG, Switzerland

CUSTODIAN: Interactive Brokers (U.K.) Ltd.

DAILY NAV PUBLICATION: Telekurs, cash.ch, finanzen.net